Editor’s Note: Jim wants the community to tell the story of blockchain's future. If you’re interested in contributing, reach out. His email is below.

The Autovate Meeting

In December 2017, I reached out to Cliff Banks, the automotive reporter extraordinaire at the forefront of M&A activity in the automotive industry.

He might know as much, if not more, about sports. Cliff's passion extends beyond sports; he cares about automotive, digital, people; and how the games are won, lost, and played. He brings people together and has an uncanny knack for being in the right places at the right times.

During my visits with clients in the Austin area, I noticed, as a subscriber to the Banks Report, that he had organized a new conference called Autovate. Seizing the opportunity, I called Cliff and expressed my interest in attending. I offered to help spread the word through social media, believing that his prototype event would benefit from increased visibility.

Cliff didn't require my assistance. On an icy day with temperatures in the low 20s, I arrived at an upscale hotel in Austin, where the conference room was brimming with attendees.

I settled in, eager to absorb the automotive industry's innovative developments on topics like Artificial Intelligence, Virtual Reality, and Machine Learning.

I was thrilled to be there, with eyes, ears, and mind wide open.

One afternoon session focused on "Blockchain in Automotive," a topic I knew little about yet recognized as having technological potential. The panel featured a San Francisco car dealer, offering a valuable perspective from Silicon Valley. Representatives from renowned consulting firms lent their expertise. Cliff hosted the panel, ensuring the right questions were asked.

As the discussion unfolded, it became clear that blockchain could provide much-needed operational transparency in an industry characterized by opacity—an ability to secure public records of immutable transactions now existed. In a world often clouded by intentional ambiguity, I saw some of blockchain's potential to bring clarity to the automotive industry.

The consultant's insights piqued my curiosity, but Cliff cut to the chase and asked the dealer, "Does this make sense for the retail world?"

"No," the dealer replied. Full stop.

Cliff smiled and asked for the dealer to go on.

As the dealer then explained, there’s no incentive for a dealer to embrace operational transparency for competitive reasons. Why would they willingly share transactional information, profit margins, or financing details, potentially enabling their competitors or, worse yet, creating unforeseen legal challenges? It made no sense, especially regarding the repair histories of cars—one of the key elements mentioned by the consultants—because other parts of the industry handled it. Think CarFax.

The consultants argued for the benefits that would accrue to the ecosystem. Still, the dealer remained unconvinced, stating that it was ultimately the OEM's responsibility to track vehicle production and provide retail-related details on warranty items or parts availability.

Considering the strength of the dealer’s conviction, I couldn't envision retailers willingly engaging in blockchain, much less finding a way to reap its benefits, especially this month or next—my standard time horizon for an item to create a profitable impact in automotive retail.

My conclusion: Consultants won't be the decision-makers in automotive retail anytime soon. The blockchain concept would wait. And wait, it has.

The entire experience reminded me of a meeting with Saatchi & Saatchi circa 2005 when I worked on the OEM side with Toyota for the Houston-based private distributor that otherwise functions as a regional sales office.

The LA-based agency suggested investing in pay-per-click advertising via Google.

During the meeting, firmly entrenched on the client side, I openly questioned the logic of spending more money to appear in sponsored, paid positions when we already had free, organic visibility. Saatchi provided compelling reasons, but I couldn't fathom its financial or practical sense then. We chose to wait, practicing Toyota's philosophy of continuous improvement—Kaizen.

We watched, we waited, and the space evolved. Network effects took hold, and Google eventually became a multi-trillion-dollar company based on the concept that Saatchi presented.

Today, history, while not repeating, certainly rhymes. The right things at the correct times matter most because the right things at the wrong times are still wrong.

Back to the Autovate meeting. On my drive home from Austin, I contacted a few CFOs from larger automotive groups, as finance might be more excited by the potential than an operationally minded retailer.

The CFOs failed to see how blockchain could be a player in the automotive sector. "It's not like the internet," one decision-maker advised.

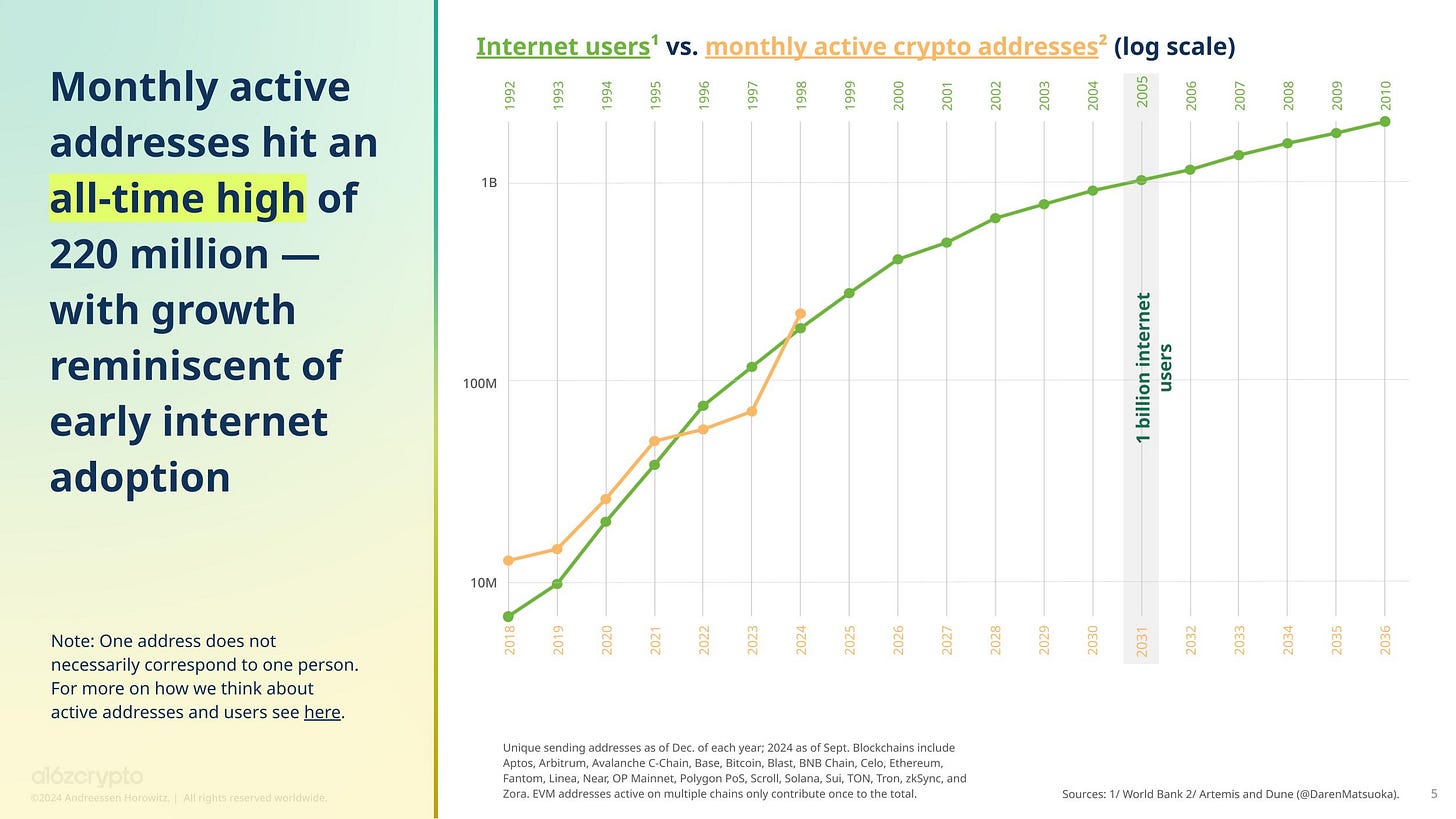

However, I now realize that blockchain is, in fact, reminiscent of the internet, with one exception. It'll likely turn into a bigger deal.

The chart below compares the timeline of Internet adoption with blockchain utilization. In internet terms, the blockchain is taking shape with an eerily similar adoption climb. The use case will continue to grow as the industry goes where the people are.

Looking back, automotive retailers eventually accepted credit cards in addition to cash and checks. We’re still in the early innings of Bitcoin as a payment mechanism. Ultimately, the industry will go where the money is.

Desk managers see the opportunity—it’s their dream and a way out of the daily grind. Libertarian dealers will accumulate the crypto assets on their balance sheet. Others will use it as a catalyst to start their conversations with prospective customers.

That’s how impact starts—in the “now” part of a new transactional vertical.

Then OEMs will espouse the sunrise of blockchain as they sunset the corporate-controlled digital factory arrangements of the 2010s. The irony of the disintermediation in each instance won’t be lost on marketplace participants as more efficient solutions free up working capital and establish smoother, more profitable customer transactions—among other yet-to-be-determined benefits and detriments in a developing ecosystem.

We are at the happening.

With this knowledge, I’m on a journey of a thousand steps, aiming to highlight blockchain's use cases within one of the world's largest industries—automotive. Will the concentric circles overlap and be substantial enough to make a meaningful difference in our lifetimes? Only time will tell.

I’ve outlined 22 chapters for the book mentioned and cover pictured above, but I am more interested in hearing your stories. If you’re interested in contributing a chapter to the collective or have concepts you’d like to discuss, please reach out to me via email: jim@localsearchgroup.com

Educate your dealers. Relieve their fear and doubt. Tall task but must be done.